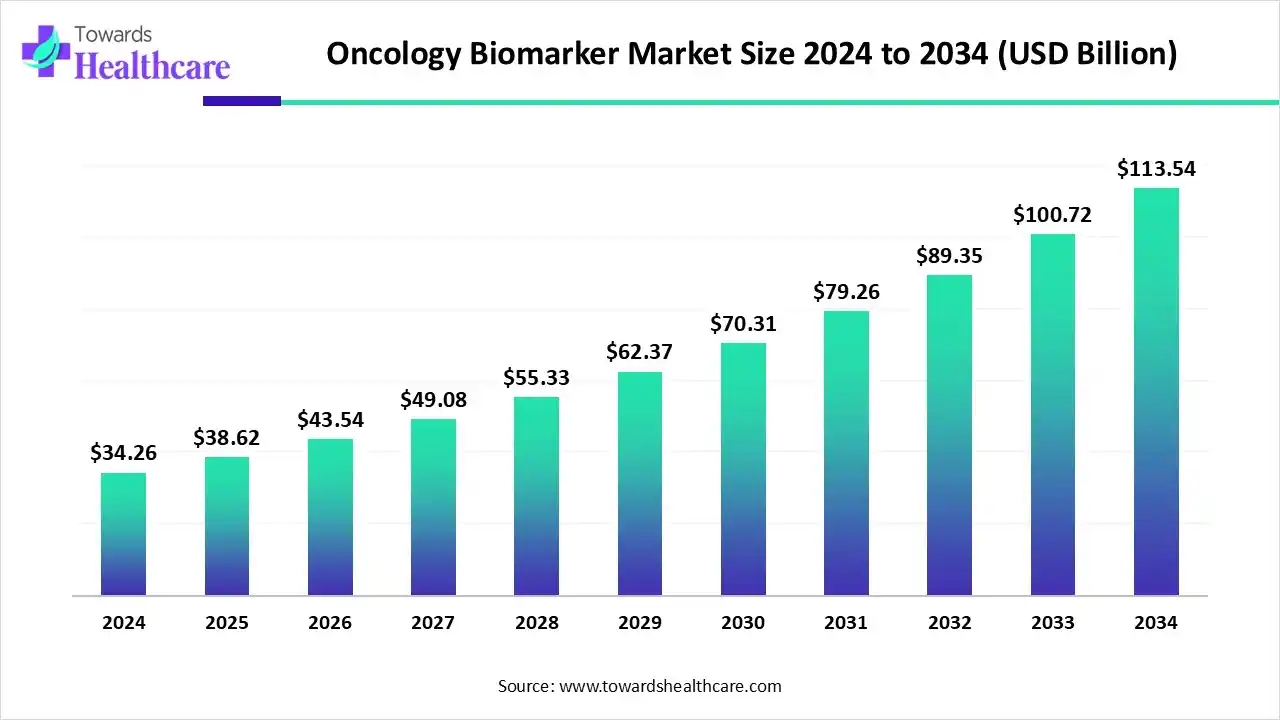

Oncology Biomarker Market Accelerates Toward USD 113.5 Billion by 2034

The global oncology biomarker market size is calculated at USD 38.62 billion in 2025 and is expected to reach around USD 113.54 billion by 2034, growing at a CAGR of 12.73% for the forecasted period.

Ottawa, Nov. 21, 2025 (GLOBE NEWSWIRE) -- The global oncology biomarker market size was valued at USD 34.16 billion in 2024 and is predicted to hit around USD 113.54 billion by 2034, rising at a 12.73% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

The oncology biomarker market is surging because of increasing adoption of precision medicine, the growing incidence of cancer, and technological advances such as next-generation sequencing (NGS) and liquid biopsies that enable earlier, more accurate detection.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/6326

Key Takeaways:

- Oncology biomarker industry poised to reach USD 34.16 billion by 2024.

- Forecasted to grow to USD 113.54 billion by 2034.

- Expected to maintain a CAGR of 12.73% from 2025 to 2034.

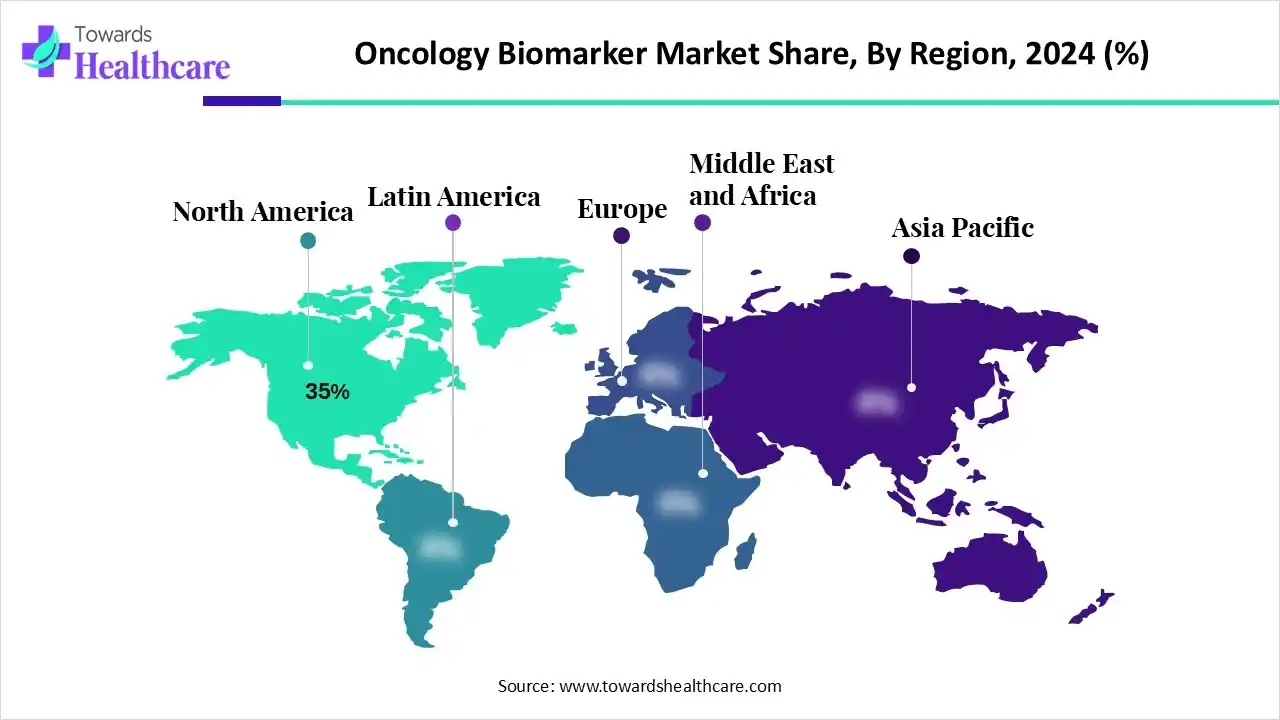

- North America held approximately a 35% share in the global oncology biomarker market in 2024.

- Europe is expected to be a significantly growing region during the forecast period.

- By biomarker type, the genomic biomarkers segment held an approximate 35% share in the market in 2024.

- By biomarker type, the proteomic biomarkers segment is expected to be the fastest growing during the forecast period.

- By application type, the diagnostic testing segment held approximately a 50% share in the market in 2024.

- By application type, the prognostic testing segment is expected to be the fastest growing during the forecast period.

- By cancer type, the breast cancer segment held approximately a 25% share in the market in 2024.

- By cancer type, the lung cancer segment is expected to be the fastest-growing during the forecast period.

- By end user, the hospitals and diagnostic laboratories segment held an approximate 40% share in the global oncology biomarker market in 2024.

- By end user, the research and academic institutes segment is expected to be the fastest growing during the forecast period.

Market Overview:

What is Fueling Global Oncology Biomarker Market Rapid Growth?

The global oncology biomarker market is experiencing strong growth as a result of the increasing incidence of cancer, the growing demand for personalized and targeted therapies, and increased investments in diagnostic infrastructure. The oncology biomarker market includes genomic, proteomic and other molecular biomarkers used in diagnostic, prognostic and predictive applications in oncology. Innovations such as liquid biopsy, artificial intelligence-based analytical platforms, and high-throughput sequencing will enhance the pace of biomarker discovery and clinical utility.

Additionally, regulatory pathways and reimbursement practices are supportive of biomarker adoption and utilization in hospitals, research centers and diagnostic laboratories. As biomarker-driven therapies receive approval, the use of companion diagnostics will increase to stratify a patient population to enhance treatment decisions related to therapy.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Key Indicators and Highlights

| Table | Scope | |

| Market Size in 2025 | USD 38.62 Billion | |

| Projected Market Size in 2034 | USD 113.54 Billion | |

| CAGR (2025 - 2034) | 12.73 | % |

| Leading Region | North America by 35% | |

| Market Segmentation | By Biomarker Type, By Application, By Cancer Type, By End-User, By Region | |

| Top Key Players | F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific Inc., bioMérieux SA, Merck & Co., Inc., Hologic, Inc., Sino Biological Inc., Myriad Genetics, Inc., Caris Life Sciences, Guardant Health, Foundation Medicine, Inc., Exact Sciences Corporation, NeoGenomics Laboratories, Inc., Adaptive Biotechnologies Corporation, 23andMe, Inc., Quest Diagnostics Incorporated | |

Latest Launched Oncology Biomarker Platforms

Major Growth Drivers:

| Company | Platform | Application | Source |

| Bangkok Dusit Medical Services Public Company Limited (BDMS) | BDMS SPOT-MAS | Detects early-stage cancer cells of ten major cancer types - ovarian, breast, gastric, lung, head, liver, neck, oesophageal, pancreatic, colorectal, and endometrial cancers | BDMS Launches SPOT-MAS Early Cancer Screening Programme |

| Ataraxis AI and MEDSIR | Integrated artificial intelligence into multiple major international trials | Identify biomarkers and optimize treatment | MEDSIR and Ataraxis AI Launch Research Collaboration to Evaluate AI-Powered Platform as a Predictive Tool in Breast Cancer Randomized Clinical Trials |

| Exact Sciences Corp. | Cancerguard™ test | Analyze multiple biomarker classes and detect a wide range of cancers | Exact Sciences Launches Cancerguard™, First-of-Its-Kind Mul… |

| Biodesix and Association of Pulmonary Advanced Practice Providers (APAPP) | CME-accredited educational programs focused on diagnostic biomarkers in Lung Nodule and Lung Cancer patient programs | Address the critical need for improved lung cancer detection | Biodesix Launches First-Ever Lung Cancer Biomarker Education Program for APPs | BDSX Stock News |

| Metropolis Healthcare | TruHealth Cancer Screen 360 | Integrated Cancer Screening Panel | Metropolis Healthcare launches TruHealth cancer screen 360 to strengthen preventive oncology in India - Express Healthcare |

| Akoya Biosciences and Enable Medicine | Enable Pan-Cancer Atlas | Filter and analyze data by biomarker expression, clinical metadata, and tissue type | Breakthrough 100M-Cell Cancer Atlas Launches for Biomarker Discovery | AKYA Stock News |

| LuNGS Alliance | Free Lung NGS (Next Generation Sequencing) biomarker testing | To drive awareness about precision oncology as an essential, accessible, and affordable treatment plan for lung cancer treatment | LuNGS Alliance launches free lung NGS biomarker testing for lung cancer patients in India - Express Pharma |

What are the important qualities incentivizing the growth of the oncology biomarker market?

- Growth of Precision Oncology and Targeted Therapies: The oncology biomarker market is being significantly impacted by the transition away from a "one-size-fits-all" approach to cancer therapies towards precision medicine. Biomarkers can define which patients will benefit from certain targeted therapies, leading to increased efficacy and a reduced side effect profile.

- Technological Advances: New advancements in technologies such as next-generation sequencing (NGS), multi-omics platforms and liquid biopsy have improved sensitivity and reduced expense, allowing for more effective early detection of cancer biomarkers, as well as real-time monitoring of tumor dynamics.

- Rising Investment in Research & Development: Public and private funding for research and development are growing, enabling more biomarker discovery and progress for biomarker programs. Pharmaceutical and biotech companies are partnering with academic institutions to follow through with clinical validation and commercialization faster.

- Approval Incentives and Reimbursement: Governments and regulators are recognizing the value of biomarker-based diagnostics as utilities. Incentives and favorable reimbursement for biomarker diagnostics (e.g., companion diagnostics) are creating a push for more adoption.

-

Increase in Cancer Incidence Around the World: The global incidences of cancer continue to rise due to multiple factors including aging populations, lifestyle factors, and better detection methods, which create a higher necessity for more diagnostic and prognostic biomarkers in order to differentiate and manage disease better.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Key Drifts:

What Are the Trends Shaping the Oncology Biomarker Market?

- Liquid Biopsy and Non-Invasive Testing: Liquid biopsy is becoming a more common minimally invasive method, simply tracking cell-free tumor DNA or other circulating biomarkers. This means monitoring disease progression and relapse would not require repeated tissue biopsies.

- Integration of AI & Big Data Analytics: Artificial intelligence and machine learning are now being applied to large biomarker data sets to identify new signatures, predict patient response, and accelerate drug-biomarker co-development.

- Multi-Omics Approaches: Multi-omics approaches that integrate genomic, proteomic, and metabolomic data are further developing accurate and predictive biomarker panels for the purpose of enhancing the provision of customized care.

- Companion Diagnostics Expansion: Moreover, an increasing number of companion diagnostics are being approved by the FDA and EMA, which can then be used to stratify patients and personalize treatment plans, especially with the increasing number of targeted therapies available for the treatment of cancer.

-

Public-Private Collaborations & Data Sharing: Public-private collaborations to build national and international genomic databases are being increasingly taken up and are validating and accelerating the feedback loop to translate biomarkers into clinical practice.

Significant Challenge:

A key challenge in the oncology biomarker space is the regulatory burden and the expense associated with clinical validation. When validating a marker for clinical use, particularly as a companion diagnostic, there is a need for large, well-designed trials, analytical validation and regulatory approval, all of which is highly time-consuming and costly, particularly when integrating biomarker discovery in genomics, proteomics and multiple-omics platforms. In addition, discrepancies in regulatory standards across regions (for example, IVD regulations in Europe) could lead to longer timelines for market entry in various geographies and impede consumer acceptance of substantial and meaningful biomarker validated diagnostic assessments.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Regional Analysis:

North America continues to lead in the oncology biomarker industry, mainly due to the region's well-established healthcare framework, active research ecosystem, and favorable regulatory environment. The U.S. is ahead of its North American peers as a result of broad adoption of next-generation sequencing, advanced molecular diagnostics in the oncology centers, and strong reimbursement mechanisms. The FDA has clear and defined pathways for approval of companion diagnostics, which incentivizes innovative and investment. There is also strong collaboration in North America between academic institutions, biobanks, and biotechnology companies, which helps to accelerate the discovery of oncology biomarkers and their translation into clinical practice.

Europe is becoming the fastest growing region in the oncology biomarker category. The In Vitro Diagnostic Regulation (IVDR) will improve harmonization of biomarker assays and drive standardization throughout member states. Various European countries (including Germany, the UK, France and the Netherlands) are expanding previous national genomics programs and establishing cross-border collaborations to facilitate sharing of information and validating biomarkers. Furthermore, the the Health Data Space initiative will support cross-border exchange of genomic data, which will enhance clinical validation. Regulatory support and co-development of biomarker/drug submissions with the European Medicines Agency (EMA) are also helping companies to more quickly introduce companion diagnostics on the market.

Segmental Insights:

By Biomarker Type:

Genomic biomarkers, which include DNA mutations, gene fusions, and copy-number variations, remain essential to precision oncology strategies. These biomarkers indicate actionable mutations for targeted therapies, predict treatment response, and inform disease prognosis. Their widespread use in companion diagnostics, particularly in solid tumors, has established their market rates.

There will also be rapid growth in proteomic biomarkers that reflect expression level, phosphorylation status, and pathways of signaling. Furthermore, as proteomics platforms (mass spectrometry, multiplex immunoassays, etc.) achieve higher levels of sensitivity and scale, they provide a dynamic measure of treatment response and mechanisms of resistance. Such unique measures of real-time tumor behavior make proteomics valuable for prognostic and predictive potential.

By Application Type:

Diagnostic testing currently leads the oncology biomarker market. This may include genomic panels, immunohistochemistry, and liquid biopsy that can be applied to both diagnose cancer early or stratify patients for treatment. Diagnostic biomarkers are primary in directing therapy selection and informing the clinician as to which treatment instructed toward a targeted therapy, if possible.

Prognostic biomarker testing is poised for rapid growth as clinicians are increasingly interested in predicting disease progression, recurrence risk, and, ultimately patient survival. Emerging biomarkers (genomic, proteomic, transcriptomic) are being further validated to stratify patients into high- or low-risk categories to inform follow-up and adjuvant therapy and surveillance.

By Cancer Type:

Breast cancer represents a large share of the oncology biomarker market, primarily thanks to well-defined biomarkers ER, PR, HER2 status, and PIK3CA mutations. There are many companion diagnostics for biomarkers associated with targeted therapies, including PI3K inhibitors. The prevalence of breast cancer and biomarker-directed therapies make it by far the largest share.

Lung cancer biomarker adoption is happening quickly as new therapies, including targeted therapies and immunotherapies, become available. Biomarkers, including EGFR, ALK, ROS1, among others, are being adopted rapidly. Emerging biomarkers, tumor mutational burden (TMB) and circulating tumor DNA, also contribute to lung cancer biomarker adoption. The high unmet need, combined with frequent testing and monitoring needs, leads lung cancer to be one of the fastest growing segments in the oncology biomarker market.

By End User:

Hospitals and diagnostic laboratories are the leading end-user segment in the market since these are primary sites of in vitro diagnostics (IVD) biomarker testing. Hospitals and diagnostic laboratories perform genomic panels, immunohistochemistry, and liquid biopsies, in some cases already part of clinical workflows to aid in diagnoses, prognosis and/or therapeutic stratification. Moreover, the existing infrastructure and patient volume also make them key players in the biomarker market.

Research and academic institutes are set to see the fastest growth across end users, as they represent the driving force for biomarker discovery, validation, and clinical translation. Research and academic institutes are also involved in translational research, early-phase clinical trials, and biobank activities. Coupled with partnerships with biotech and pharmaceutical companies, research and academic institutes are critical components in the discovery of new biomarkers and development of companion diagnostics for future therapy.

Oncology Biomarker Market Value Chain Analysis

R&D

To discover, integrate, and validate new biomarkers for effective personalized cancer detection and treatment with the use of advanced multi-omics technologies, AI, and liquid biopsies are the main focus of the R&D of oncology biomarkers.

Key Players: F. Hoffmann-La Roche Ltd., Illumina, Inc., Thermo Fisher Scientific Inc., Abbott Laboratories, QIAGEN N.V.

Clinical Trials and Regulatory Approvals

The clinical trials and regulatory approval of oncology biomarkers consist of the validation of their ability to predict patient response to targeted therapies, along with the drug safety and effective use of the companion diagnostic devices.

Key Players: F. Hoffmann-La Roche Ltd., Illumina, Inc., Thermo Fisher Scientific Inc., Guardant Health, QIAGEN N.V.

Patient Support and Services

The patient support and services of oncology biomarkers involve access to advocacy groups for emotional and practical guidance, comprehensive education, and counseling to help patients understand results and implications for treatment, and financial assistance to cover the testing and treatment costs.

Key Players: F. Hoffmann-La Roche Ltd., Illumina, Inc., Thermo Fisher Scientific Inc., Guardant Health, QIAGEN N.V.

Browse More Insights of Towards Healthcare:

The global oncology drugs market is valued at US$ 204.39 billion in 2024 and is expected to rise to US$ 217.18 billion in 2025, eventually reaching approximately US$ 360.79 billion by 2034. This growth reflects a steady CAGR of 6.29% from 2025 to 2034.

The oncology API market is also gaining momentum, increasing from USD 41.79 billion in 2024 to USD 43.95 billion in 2025, with projections indicating it will reach nearly USD 69.55 billion by 2034 at a CAGR of 5.24%.

Meanwhile, the global oncology devices market is witnessing accelerated expansion, growing from US$ 150.35 billion in 2024 to US$ 177.17 billion in 2025, and is forecasted to surge to around US$ 776.3 billion by 2034, registering a strong CAGR of 17.84%.

The oncology drug discovery market is set for robust growth through 2034, powered by advances in precision medicine, AI-driven discovery platforms, and a rapidly expanding pipeline of targeted therapies.

Similarly, the oncology automation market is rising steadily, advancing from US$ 2.82 billion in 2024 to US$ 3.12 billion in 2025, and projected to hit US$ 7.77 billion by 2034 at a CAGR of 10.68%.

The oncology NGS market is scaling rapidly as well, increasing from US$ 508.95 million in 2024 to US$ 589.01 million in 2025, with expectations to reach US$ 2,193.49 million by 2034, driven by a CAGR of 15.73%.

In clinical research, the global oncology clinical trials market is set to grow from US$ 13.64 billion in 2024 to US$ 14.36 billion in 2025 and is projected to reach nearly US$ 22.85 billion by 2034 at a CAGR of 5.30%.

The oncology companion diagnostics market is expanding from USD 5.24 billion in 2024 to USD 5.7 billion in 2025, with forecasts showing it will reach USD 12.07 billion by 2034, supported by a CAGR of 8.73%.

Oncology biosimilars are among the fastest-growing segments, rising from US$ 6.7 billion in 2024 to US$ 7.94 billion in 2025, and projected to reach US$ 36.23 billion by 2034, marking an impressive CAGR of 18.47%.

The global DNA methylation market size reached USD 2.05 billion in 2025, grew to USD 2.33 billion in 2026, and is projected to hit around USD 7.36 billion by 2035, expanding at a CAGR of 13.64% during the forecast period from 2025 to 2034.

Recent Developments:

In February 2025, Acrivon Therapeutics’ OncoSignature assay, developed using its AP3 proteomics platform, was granted Breakthrough Device status by the FDA for identifying endometrial cancer patients likely to benefit from its CHK1/2 inhibitor ACR-368.

Oncology Biomarker Market Key Players List:

- F. Hoffmann-La Roche Ltd.

- Thermo Fisher Scientific Inc.

- bioMérieux SA

- Merck & Co., Inc.

- Hologic, Inc.

- Sino Biological Inc.

- Myriad Genetics, Inc.

- Caris Life Sciences

- Guardant Health

- Foundation Medicine, Inc.

- Exact Sciences Corporation

- NeoGenomics Laboratories, Inc.

- Adaptive Biotechnologies Corporation

- 23andMe, Inc.

- Quest Diagnostics Incorporated

Segments Covered in the Report

By Biomarker Type

- Genomic Biomarkers

- Proteomic Biomarkers

- Immunohistochemical Biomarkers

- Metabolomic Biomarkers

- Other Biomarkers

By Application

- Diagnostic Testing

- Prognostic Testing

- Predictive Testing

- Monitoring and Surveillance

- Others

By Cancer Type

- Breast Cancer

- Lung Cancer

- Colorectal Cancer

- Prostate Cancer

- Liver Cancer

- Other Cancers

By End-User

- Hospitals and Diagnostic Laboratories

- Research and Academic Institutes

- Pharmaceutical and Biotechnology Companies

- Others

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/6326

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.